Tell us: What do you know about e-invoicing? But more importantly, how much do you know about the e-invoicing mandates and regulatory changes being introduced across Europe that will affect B2Bs with operations or clients on this continent? Not much?

That’s OK. That’s why we’re here: To keep you informed and help you find the best e-invoicing tool when deciding to upgrade your invoicing system.

As if running an agency is not demanding enough, you also need to keep track of regulatory changes that affect (and change) the way your business operates. To make it easier, we’ve done the research and summarized the most important things you need to know, and consider when e-invoicing mandates become relevant to your business. We explain e-invoicing in simple terms, share upcoming compliance mandates, and help you prepare your agency for the switch to e-invoices!

What is e-invoicing?

Electronic invoicing or e-invoicing is the process of sending and receiving electronic invoices between a buyer and seller in a special, structured data format. This format allows the fields in the invoice, like invoice number, amount, tax identification number, and so on, to be recognized and processed digitally by Account Payable (AP) and Enterprise Resource Planning (ERP) automation software.

But what does this mean in reality? It means businesses using e-invoices remove the manual work of processing paper invoices, which makes it more cost-effective and efficient. But it also means governments have more control, full visibility, and greater transparency when it comes to tax compliance.

Insight: While e-invoices may not necessarily be directly connected to government taxation institutions, they are designed in a way that lets them integrate with tax authorities.

What’s the difference between a digital invoice and an e-invoice?

Even though both e-invoices and digital invoices are digital documents they differ in one crucial way:

Standard digital invoices – A standard digital invoice is usually a Word document or PDF file which can be created digitally or scanned from a paper format and turned into a digital invoice document. While all three can be viewed digitally, only the Word and PDF files can be processed digitally (usually through a link within the invoice file).

Electronic invoices or e-invoices – An electronic invoice or e-invoice is a structured data file that in most cases cannot be understood by humans but by machines (that’s what makes them electronic!). Some of the most common e-invoice formats include XML, PEPPOL, and JSON. All e-invoices can be processed automatically.

Global compliance changes to e-invoicing

Before we jump into why you, as an agency founder or a registered business owner, need to be across the latest e-invoicing compliance changes and how they will affect you as a B2B operating across borders, let's take a look at how the global move towards e-invoicing began. That will help you understand and appreciate the logic behind why:

- Governments are driving the initiative

- Industry-leading businesses are proactively adopting this technology

The first countries to mandate e-invoicing were Brazil (2008) and Mexico (2011). As governments around the world saw the benefits of instant visibility and transparency of tax-related transactions and the substantial drop in the potential of tax fraud, e-invoicing started to make its way across the continents.

On top of that, because a large number of businesses operate globally, as well as locally, both governments and businesses saw a need for a more efficient, streamlined, compliant, and transparent way of billing and collecting payments. Being able to track and monitor transactions in real time has become paramount and e-invoicing provides the perfect solution for these pain points.

Which countries have e-invoice mandates?

Today, more than 80 countries globally have various levels of e-invoicing mandates. Another 50 have announced the introduction of new or additional mandates from 2025.

According to a report from OpenText, it’s expected all 200 countries with a Value Added Tax (VAT) or Goods and Services Tax (GST) will have mandatory e-invoicing controls and regulations in place by 2030 (that’s only five years from now!).

What about the USA? The USA is not included in this list because it does not have a nationwide VAT or GST system for formal tax invoice regulations that would allow it to set an official national mandate. This is the main reason why e-invoicing in the USA is still optional for B2B financial transactions. In 2023, The US Government ran an e-invoicing pilot, and some businesses and state governments have adopted the technology because of the benefits it brings to their operations.

Which countries are introducing B2B e-invoicing mandates in 2025?

When it comes to B2Bs, over the next few years the following European countries have approved B2B e-invoicing mandates:

- Germany – Mandatory e-invoicing receipt by January 2025, e-invoicing for companies by January 2027.

- Belgium – Mandatory B2B e-invoicing by January 2026.

- Poland – Mandatory e-invoicing from February 2026.

- France – Mandatory e-invoicing receipt for everyone from September 2026. E-invoicing issuance by September 2026 for large and mid-cap companies, and September 2027 for small and medium-sized enterprises (SMEs).

As each EU country moves away from paper and digital invoices and adopts e-invoicing they’ll need to meet the EN 16931 standard from the European Committee for Standardization. This will make it possible for all EU countries to have one standardized format so they can integrate, streamline, and align e-invoicing for cross-border transactions that meet local compliance requirements.

What about the UK? While the UK promotes the use of e-invoicing and much of its private sector has adopted this new technology for cost-saving and business operation efficiency, it does not have an official, legally binding mandate.

What this means for agencies & B2Bs

Whether you have operations in mandated countries or not, as an agency or B2B that regularly deals with cross-border transactions or clients, it’s a good idea to start getting ready to implement e-invoicing. Because the business world is moving in this direction, and sooner or later, there will be a global e-invoicing standard and expectation that all businesses will need to meet.

So if you don’t want to find yourself scrambling at the last minute looking for the best e-invoicing software for an agency, SME, or B2B, as a registered business owner, you need to stay informed and understand what’s expected of you (and by when!).

That way, you can update your agency invoicing system and processes to make sure your business remains compliant when charging clients.

To help you get the ball rolling, we’re answering some of the questions you’re bound to have for the upcoming mandates rolling out across Europe.

Mandatory e-invoicing: for all transactions with countries with mandates

Even if your business is registered in a country that doesn’t have mandatory B2B e-invoicing, you still need to comply with the accepted formats and standards legally required by the country you issue invoices to.

For example, your business might be registered in the USA, where there are no e-invoicing mandates yet. However, you have clients in Germany or Belgium that already have or are in the process of introducing mandates. This means you’ll need to upgrade your invoicing systems and processes to meet the e-invoicing compliance requirements of both Germany and Belgium. Because both countries align with the EN 16931 standard, you’ll need to make sure your e-invoicing system meets this standard.

E-Invoicing formats: how do you know which format is accepted

Before you go out and get yourself an e-invoicing provider, you’ll need to make sure it supports the invoice format your clients’ finance and accounts departments will accept.

Accepted e-invoicing formats may differ from region to region however the most common ones globally include:

- XML-based formats

- PEPPOL

- JSON

The most widely used and accepted e-invoice format across Europe is XML. This can be

- UBL 2.1 (XML) – A standard XML format for business documents and invoices with structured invoice data for machine reading.

- Factur-X (PDF/A-3 with embedded XML) – A hybrid invoice format that combines a visual PDF for humans to read with an embedded XML file that carries all the structured invoice data for machines to read.

- PEPPOL BIS 3.0 (XML) – A global e-invoicing standard format that many EU countries support and is most widely used by the public sector.

- CII (XML) – Designed for the private and public sectors, and also meets the core invoice structural invoice data model requirements of EU’s EN16931 standard.

- ZUGFeRD (PDF/A-3 with embedded XML) – The German standard for e-invoicing that aligns with the EU’s EN16931 standard.

Penalties: what risks do you face if you don’t comply?

There are a number of risks your agency or B2B business may face if you don’t comply with the rules, regulations, and e-invoicing mandates. These include:

- Fines – You may face fines of up to €2,000 or more per invoice. Your trading partners may also be penalized or drawn into an audit.

- Sanctions – Not meeting the compliance requirements, may be seen as tax evasion and this could make your business liable to sanctions under tax and criminal law.

Choosing an e-invoicing software tool for your agency

There are over 2,000 e-invoicing software providers worldwide. However, a vast number of those, with their pricing and implementation models cater to large multinational corporations, enterprises, and government entities.

When it comes to the SME category which agencies and many B2Bs fall into, the number of suitable options with affordable subscription plans is limited.

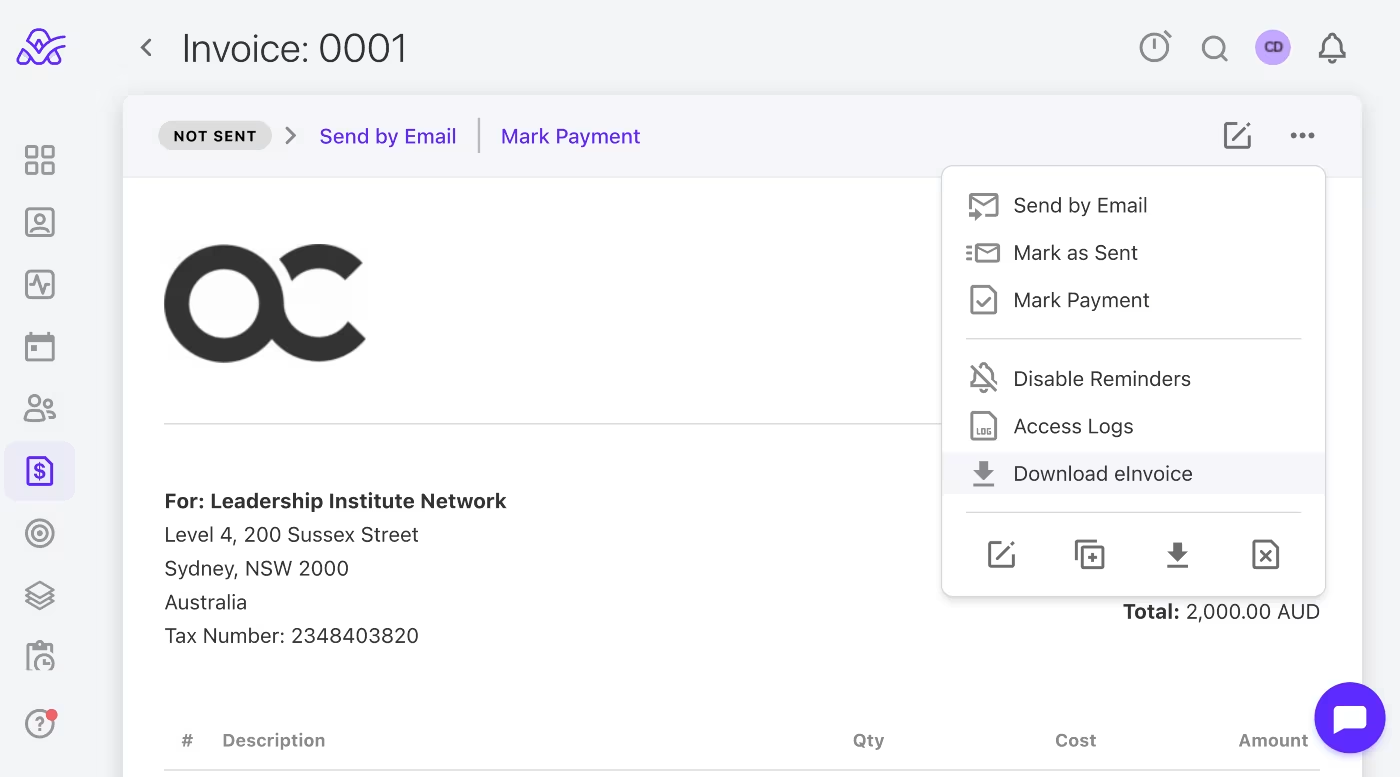

ActiveCollab is a collaboration and producitivty tool for service-based businesses that includes an e-invoicing solution within our invoicing feature tailored for service businesses.

It’s ideal for marketing and digital agencies, consulting and coaching businesses, and startups that operate globally and are keen to centralize their client and workflow processes into one platform.

The e-invoicing feature within ActiveCollab will have you covered with easy-to-do e-invoicing that supports the XML data file format and meets European compliance and regulation standards (EN16931)

To set up your clients for e-invoicing on the platform, all you need is their standard business information such as name and address, as well as the relevant tax identification number (VAT, UTR, GST, EIN, BTW, CVR) and you’ll be ready to go.

Some of the e-invoicing features (and benefits!) you get with ActiveCollab include:

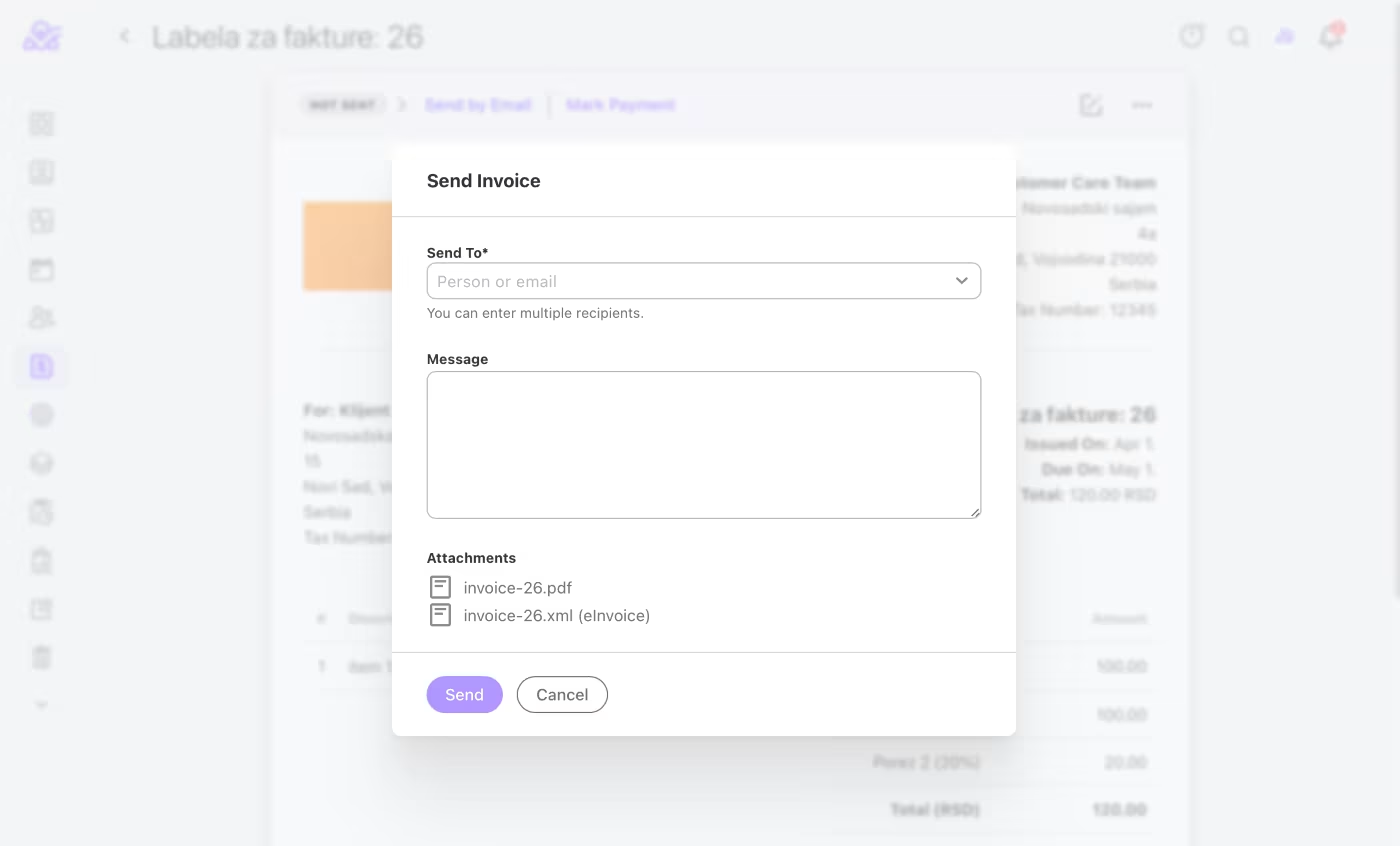

E-invoices & digital invoices – ActiveCollab lets you create and send electronic (XML) and digital (PDF) invoices in seconds. When done, you can email your digital or e-invoice (or both) to your client directly from the tool, or download it and send it via another channel.

Tax rate, currency & language customization – You won’t need to remember or re-enter various tax rates every time you create an invoice. You can customize your invoice settings by adding the tax rate types and percentages you use, and selecting them from the drop-down menu when you create the invoice. You can also set a default tax rate for the one you use most often, and select and adjust invoice currency and language as needed.

Recurring e-invoices & reminders – If you have clients on retainers or for recurring services, you can create a recurring e-invoice that will be sent out at the frequency you select (weekly, fortnightly, monthly, quarterly, or annually). Because we’ve automated the task for you, you won’t have to waste time on repeat administrative tasks. Check out the video to see how easy it is to set up.

Benefits of e-invoicing for B2Bs

For B2Bs and service-based businesses, whether you’re an agency, consulting business, or startup, e-invoicing brings a mix of benefits:

Cost savings & faster processing – E-invoicing removes manual invoice processing which means businesses can cut administrative costs. Also, because e-invoicing is instant, you get faster approvals and payments.Fewer errors & trackability – Because there’s no manual data entry, you remove the potential for error and payment delays. On top of that, you can also monitor where every invoice is at and simplify audits and compliance checks because every invoice you’ve created can be traced and tracked.

System integration – When you integrate your e-invoicing tool with an accounting and Enterprise Resource Planning (ERP) system, you can set up automated approvals and generate reports that give insights into your cash flow and payment trends.

Scalability – For businesses that want to grow, e-invoicing lets you adapt to an increased volume of invoices without increasing processing and resource costs.

Test drive ActiveCollab’s e-invoicing tool for SMEs & B2Bs

As e-invoicing becomes the norm for many B2Bs with global operations, agencies and SMEs will need to find software tools that will meet and support the mandates and regulatory requirements of the countries they do business with.

As a multi-featured tool for service-based businesses, ActiveCollab gives you a platform that centralizes and streamlines your client and team workflows. Our tool lets you run client projects from initiation to e-invoice.

Offering both digital and e-invoice solutions that meet XML file format e-invoicing requirements across the EU and many other countries, you can be sure you remain compliant when sending e-invoices across borders.

ActiveCollab is a software platform that has been specifically designed to cater to the needs of agencies, consultancies, and startups with teams of 20 or more people. It also offers online payments through PayPal and Stripe which makes collecting payments quicker and easier for you and your customers.

Looking for an e-invoicing tool that fits your agency budget and ticks all the legal requirements of your customer base? Give ActiveCollab a test drive. Sign up for our 14-day free trial or book a demo to have one of our people walk you through the product.