No, this is not an updated version of a 2023 list. It’s the real deal: Six of the best e-invoicing tools in 2025, selected carefully to suit small and medium-sized enterprises (SMEs), specifically.

With over 99% of businesses in the European Union (EU) and the USA classified as SMEs, you would think the list would be longer. But it’s not, and we’ll tell you why: E-invoicing hasn’t been mandated globally yet. It’s being introduced gradually, where every country goes at its own pace. And as the number of mandated countries grows, so will the providers. But for now, it’s a select few you have to choose from.

What we have here is a small but refined list. And that’s a good thing. Because it means you won’t have to scroll through dozens of generalized (useless!) software recommendations. Only the ones that have been created with SMEs in mind.

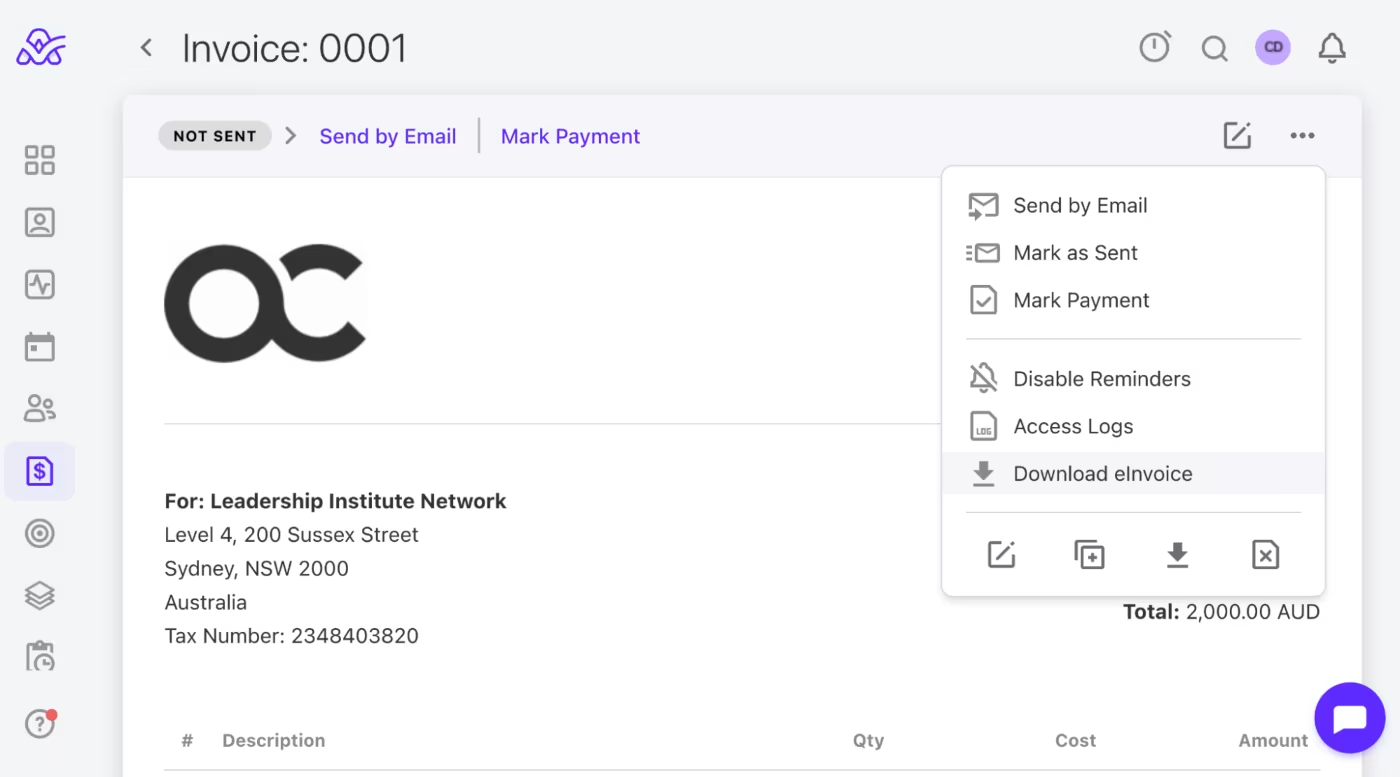

1. ActiveCollab

OK, so we might be biased, but we also know our product best. That’s why we’re the first option in this list of best e-invoicing tools for SMEs. We recently added an e-invoicing option to invoicing and expense tracking feature. The platform is specially designed for service-based businesses that operate globally and need a reliable client invoicing software solution.

It’s ideal for marketing and digital agencies, consulting and coaching businesses, and startups.

Features

When it comes to e-invoicing, ActiveCollab will have you covered with an easy-to-do e-invoicing solution that meets European compliance and regulation standards (EN16931). All you need to set up your clients for e-invoicing is their standard business information, such as name and address, as well as the relevant tax identification number (VAT, UTR, GST, EIN, BTW, CVR) and you’ll be ready to go.

Some of the e-invoicing features (and benefits!) you get with our tool include:

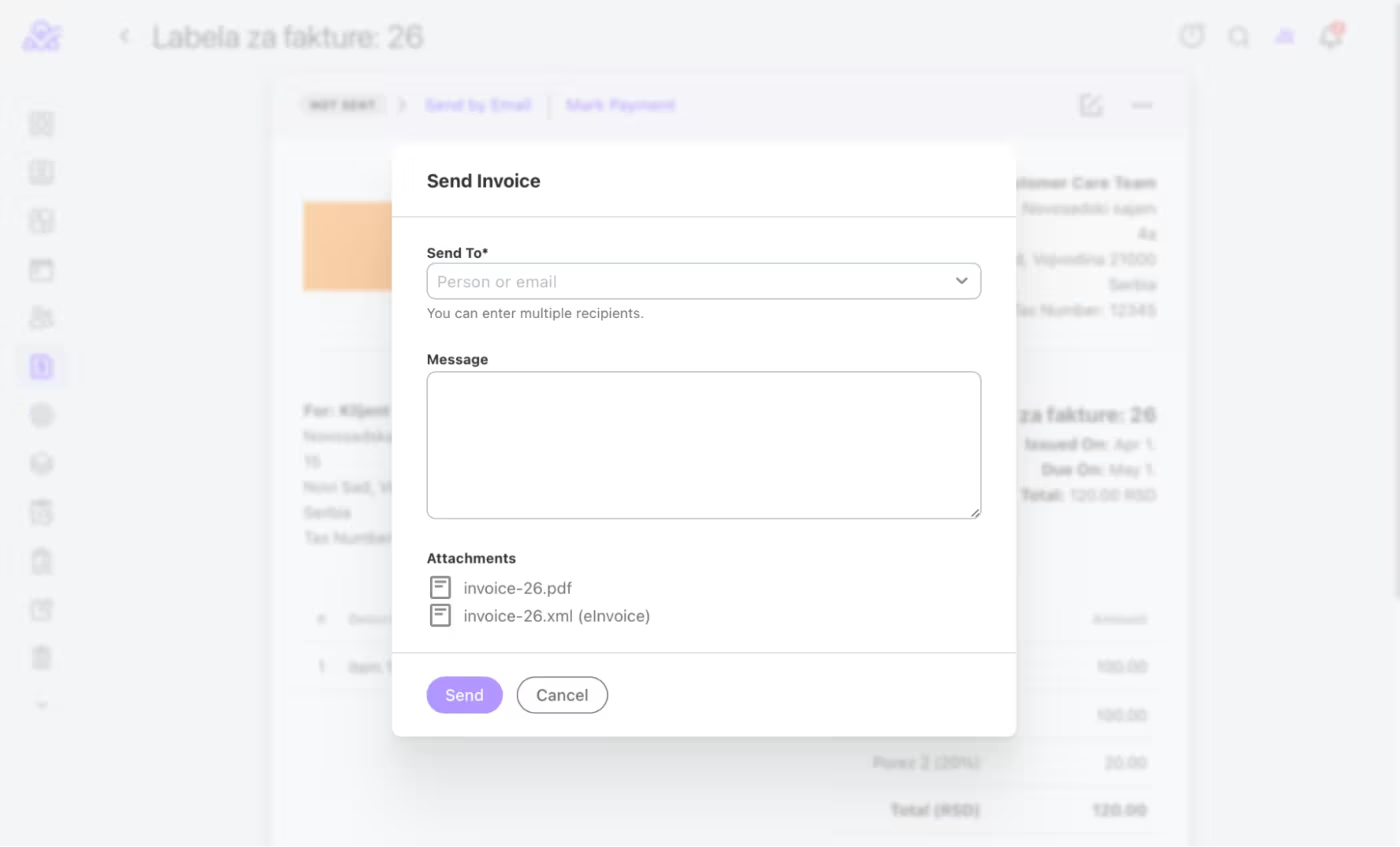

E-invoices & digital invoices – ActiveCollab lets you create invoices in XML (e-invoice) or PDF (standard digital invoice) formats in seconds. When done, you can email your digital or e-invoice (or both) to your client directly from the tool, or download it and send it via another channel.

Compatible with accounting software – When you create a client estimate or invoice, the tool automatically formats it in a way that makes it compatible with e-invoicing accounting software so it can be processed.

Tax rate, currency & language customization – You won’t need to remember or re-enter various tax rates every time you create an invoice. You can customize your invoice settings by adding the tax rate types and percentages you use, and selecting them from the drop-down menu when you create the invoice. You can also set a default tax rate for the one you use most often, and select and adjust invoice currency and language as needed.

Set invoice service items & rates – If you have different rates for different clients, you don’t need to enter them manually. You can set individual service item rates (and tax rates) for projects or tasks so you can quickly select them from a drop-down menu each time you need to create a new invoice.

Recurring e-invoices & reminders – If you have clients on retainers or for recurring services, you can create a recurring e-invoice that will be sent out at the frequency you select (weekly, fortnightly, monthly, quarterly, or annually). Because we’ve automated the task for you, you won’t have to waste time on repeat administrative tasks. Check out the video to see how easy it is to set up.

Reviews, pros & cons

Most user reviews point to the simple, user-friendly, intuitive interface that’s easy to learn and use. Some other key pros and cons include:

Pros

- Client profile customization for invoicing – You don’t have to create every invoice from scratch. By setting up client profiles, you can prepopulate most of the fields in your e-invoice with customizable currency, tax rates, language,e, and rates.

- Time-tracking for deliverable tasks – One thing that stands out is the tool’s time-tracker that you can use to track the hours your team spends on individual client projects and tasks, which then lets you turn them into invoices.

- Online payments – The other thing you and your customers will love is the online payment options which remove the need for expensive funds and bank transfer dramas for your customers. At the click of a button, your clients can pay via PayPal or Stripe (if they want to use credit cards), the moment they receive your e-invoice. This also means you’ll probably get paid faster.

- Easy to learn and use – If you’re tired of using tools that have a steep learning curve, you won’t have that problem with ActiveCollab. The interface is easy on the eye and it’s a highly intuitive tool that won’t take too long to get the hang of.

- Affordable pricing & consolidation – Another important thing to call out about ActiveCollab is that you get a bunch of handy features consolidated all into one platform at a price you would normally pay for one single-function tool.

Cons

- Limited mobile app – While there is a mobile app for Android and iOS, the functionality within the app is not as advanced as the one on the desktop version.

- More than e-invoicing – ActiveCollab isn’t just an e-invoicing tool. When you sign up for the product, you get a bundle of business management tools and features. Depending on what you are looking for, it may offer more than you need.

Pricing

You can find more details on our pricing page but if you up to give us a shot, you can get our 14-day free trial, or book a demo and let us walk you through it!

2. Quonto

Qonto is a French neo-bank that offers an integrated platform with banking and financial management solutions that include e-invoicing for self-employed professionals, microenterprises, and SMEs in Germany.

It’s a regulated payment institution, that currently operates in Germany, Italy, and Spain, but in September 2024, it announced its plan to open offices in Austria, Belgium, Portugal, and the Netherlands.

Features

When you open an online business account with a German IBAN with Qonto, you get e-invoicing functionality as part of the banking platform. Some of the key e-invoicing features include:

- Invoice formats – Qonto supports all valid EU invoice formats including XRechnung (XML, EN-16931), and ZUGFeRD (visual PDF and structured XML data).

- Quotes – Create compliant quotes and turn them into invoices within the business account app.

- Integrations – Qonto lets you connect to dozens of business tools like Slack for account activity notifications, Zapier, Google Docs, and over 50 accounting apps where you can export transactions and receipts.

Reviews, Pros & Cons

Most of the online user feedback is positive when it comes to the app interface. When it comes to invoices, users point out the smooth process to generate invoices and instant transaction balances. Some other pros and cons include:

Pros

- Quick & easy set-up – Customers seem to be super pleased with the onboarding process and quick set-up.

- High-quality banking – With innovative banking features customers seem to be happy with the platform’s seamless finance processing and transaction solutions.

Cons

- High pricing – When compared to other e-invoicing providers, the pricing models can be a little on the higher end.

- Bundle package – You can’t just have the e-invoicing solution, you need to open an online account with Qonto. For anyone happy with their existing banking provider, this might be too much work to change.

Pricing

All of Qonto’s plans come with e-invoicing. For microenterprises of 1-9 employees, the Basic plan is €9 per month. For teams with 10+ employees, the Essential plan is €49 per month.

3. Zervant

Zervant is an invoicing, e-invoicing, and financial management tool, specially designed for freelancers, contractors, and small businesses across Europe. It supports five languages: English, Dutch, French, Finnish, German and Swedish.

It’s ideal for UK-based small businesses that want an e-invoicing, time-tracking, and simple finance management tool all wrapped into one.

Features

If you’re after an affordable e-invoicing tool that also offers additional finance features you’ll have the basics covered with this bundle. Depending on the plan you choose, some of the features you can expect to get include:

- E-invoicing – To issue an e-invoice, you’ll need your clients’s e-invoice number. Zervant offers three types of e-invoice address formats: VAT number, GLN, and DUNS.

- Quotes & Estimates – You can create quotes and estimates, track acceptances on your dashboard, and then turn them into invoices.

- Time tracking – With a simple time-tracking feature you can track hours spent on client work and convert them into invoices.

- Payments – Online payments offered through Stripe for major debit and credit cards worldwide in over 135 currencies, and online banking payments with Tink.

Reviews, Pros & Cons

Pros

- No third parties – You don’t need to have your e-invoicing address or a separate agreement with an e-invoicing operator.

- Mobile app – Zervent’s free mobile app lets you create and send e-invoices from your phone.

Cons

Customer support – Several online reviews mention inefficient and unresponsive customer support.

No editing – If you make a mistake, you can’t edit an existing invoice, you need to generate a new one.

Pricing

While Zervant does offer a free plan, to get e-invoicing you’ll need to go for the paid plans which start at €9.99 per month and come with a cap of 36 e-invoices.

4. FatturaElettronica APP

FatturaElettronica APP is an Italian e-invoicing tool. Any company or individual with a VAT and email can register and set up an account to send and receive invoices instantly.

Features

If you’re looking for a stand-alone, affordable, no-fuss e-invoicing solution, FatturaElettronica APP is a solid option. Depending on the plan you choose, some of the features on offer include:

- Formats & PDF – The tool supports XML file formats and lets you save or export invoices as PDFs.

- Imports & storage – You can import invoices from other software and get standard storage for 10 years.

- Quote & invoice – You can turn quotes into invoices and send payment reminders.

- Business reporting – You can create reports to monitor your income, expenses, and profits in real-time.

Reviews, Pros & Cons

Most reviewer feedback is positive, noting the great customer support team. Some of the key pros and cons of the tool include:

Pros

- Autofill and automatic error-checker – As you fill in your invoice, autofill and the automatic time tracker minimize the chances of error and rework.

- Accountant access – Your accountant can access your invoices with one click.

- Mobile app – The tool is also available as a mobile app for iOS and Android.

Cons

- Limited functionality – When compared to some other providers, this tool is limited when it comes to customization and additional features some businesses need.

- Limited reporting – The reporting feature is not robust and it doesn’t seem to manually balance invoices sent out and received.

Pricing

All plans let you send and receive a minimum of 500 invoices per year. Plans start at £4.99 per month.

5. Invopop

Invopop is a fairly new Madrid-based startup that offers a global invoicing solution that includes e-invoicing. It converts your service charges into locally-compliant invoices and reports them to the relevant tax authorities in the right format.

Features

If your client base is a broad, global one, Invopop might be the tool that simplifies and centralizes all your invoices (digital and e-invoices) into one place. It works through an API, offers several integrations, and comes with the following features:

- Compliant invoicing to 25 countries – Currently the tool offers compliant invoicing to a mix of countries across Europe, North and South America, Australia, India, and the United Arab Emirates.

- Tax information – The tool helps you avoid errors with tax ID validations against local databases and automatically calculates local tax rates.

- Console dashboard – Invopop’s Console is the dashboard that lets you manage and organize your contacts, documents, invoices, and workflows.

Reviews, Pros & Cons

Unfortunately, there are no online reviews of the product so there are no user insights. However, some of the things that might be considered possible pros and cons include:

Pros

- Automation features – The automatic tax calculation feature can prevent errors and delays in payments which are common with manual entering of data.

- Bundle solution – Many of the smaller e-invoicing providers are only suited to one location. Invopop covers a range of country compliance rules and regulations in one tool.

Cons

- Lack of user feedback – With no user reviews, it’s hard to know what the user experience is like, which makes it a risky purchase decision.

- Additional e-invoicing costs – The tool charges additional fees for each e-invoice sent, on top of the plan subscription fee.

Pricing

To get e-invoicing, you’ll need to sign up for the Pro plan which starts at €50 per month, and then you’ll need to pay for each invoice on top of that fee.

6. Teamleader One

Teamleader One is anewly launched e-invoicing software tool specially designed for self-employed professionals and microenterprises. It’s ideal for service providers looking for a solution that meets European e-invoicing standards, and compliance requirements.

Features

If you’re a European service provider after a simple platform that lets you create, send, and manage your e-invoice, Teamleader One is worth considering. Some of the features you can expect include:

- Peppol & e-invoicing – The platform offers ready-to-use templates and the Peppol network to create and send legally compliant invoices to your customers.

- Store and export – You can store all your invoices and accompanying documents in the tool and export them when needed.

- Monitor cash flow – Through the tool, you can monitor your cash flow to get an idea of paid invoices vs. outstanding payments.

Reviews, Pros & Cons

Because Teamleader One is a new tool, there are no online user reviews yet. However, a couple of pros and cons that might help you decide whether they are worth signing up for include:

Pros

- Free trial – You can take the tool for a test drive for free with their 7-day trial period, and you don’t need a credit card to register.

- Accounting integrations – Teamleader One will be launching integrations with existing software providers, so that’s something to keep in mind if this is another feature you are keen to have included.

Cons

- Lack of user insights – Most people like to see user feedback before they sign up for a product and the absence of it can make the buy feel risky.

- Europe focus – Unlike some of the other providers in this list, Teamleader One is focused on catering to European businesses and compliance requirements.

Pricing

The tool has an enticing pricing offer, which is probably aimed at building up their new customer base. For the entire first year, the tool will cost you just €1, and then €99 annually.

ActiveCollab: E-Invoicing, Customization and Online Payments

Many countries across the globe are setting compulsory e-invoicing mandates for tax compliance purposes. If you’re a small or medium-sized enterprise (SME) looking to adopt this new way of billing, ActiveCollab might help you end your search and tiresome online product research.

With ActiveCollab, not only will you get access to a platform that lets you create and send e-invoices in a few clicks, but you’ll also get invaluable customization options and online payments. If you need an e-invoicing solution that ensures compatibility and compliance within the European Union (EN 16931), we’ve got you covered.

Our platform lets you create and send e-invoices in Universal Business Language (UBL), made in XML. These e-invoice file formats are accepted across Europe, Australia, and Latin America. Once you create your e-invoice, you can email it directly to the client from the ActiveCollab platform or download it.

Unlike large enterprises that have entire teams to source and big budgets to pay for automation and business software, SMEs are limited in both. That’s why ActiveCollab exists. To cater to the business needs of teams with 20 to 100 people strong. We’re an e-invoicing tool specially designed for global service businesses that want to automate their billing processes and stay compliant.

Let us help you simplify your cross-border business and take the manual work out of e-invoicing. Sign up for our 14-day free trial or book a demo so one of our people can introduce you to the ActiveCollab platform.