Just 15 untracked minutes per day adds up to 60+ hours of unbilled time per year. If you're a service business, you know how these missed billable hours will translate into massive revenue losses.

While accurate and consistent time tracking can be a game-changer for your balance sheet, it remains to be a serious pain point for marketing agencies and consulting businesses whether they charge a flat rate retainer fee or work on a project basis.

However, when implemented properly, billable hour tracking can help you up your profit margin, balance your team's workloads, and make sure you get paid for every honest minute of client work. To find out how to track billable hours and introduce a process that actually works, we take you through the eight steps that promise to work wonders for every service business.

Step 1: Define billable vs. non-billable activities

Even in a small service business, determining what’s billable can be a complex task which is complicated further by things like client expectations, industry standards, and the sheer variety of tasks performed daily.

So your first step is to create clear definitions and establish boundaries around exactly what counts as billable time and what doesn’t. Yes, it’s a job in itself, but making the additional effort to clarify these boundaries is worth the trouble.

To help you get started, use the below definition and examples table to guide your classifications.

Definition | Activity Examples | |

Billable hours | Billable hours represent the time spent on tasks directly related to client work that can be invoiced and charged. | Client consultations, project work, research, email correspondence, deliverable creation |

Non-billable hours | Non-billable hours encompass all the operational activities that keep your business running but can’t be directly charged to clients. | Administrative tasks, internal meetings, business development, training |

Step 2: Establish clear expectations & billing policies for transparency

To prevent billing disputes and internal errors you need to establish clear expectations and have a billable hours policy that you can share with your clients and teams.

This can be a simple one-pager that explains:

Billable activities definition: Clearly specifies what constitutes billable client work and lists examples of billable clients tasks

Minimum billing increments: States your rounding policy and explains how partial increments are handled

Rate structure: The different rates for different types of work or team members and explains the rationale and application

Reporting frequency: Commit to providing regular time summaries or detailed invoices that show task breakdowns to clients for transparency

Many successful firms share weekly or monthly time summaries with clients, building trust and justifying invoices before they’re issued. This practice significantly reduces payment delays and disputes while strengthening client relationships.

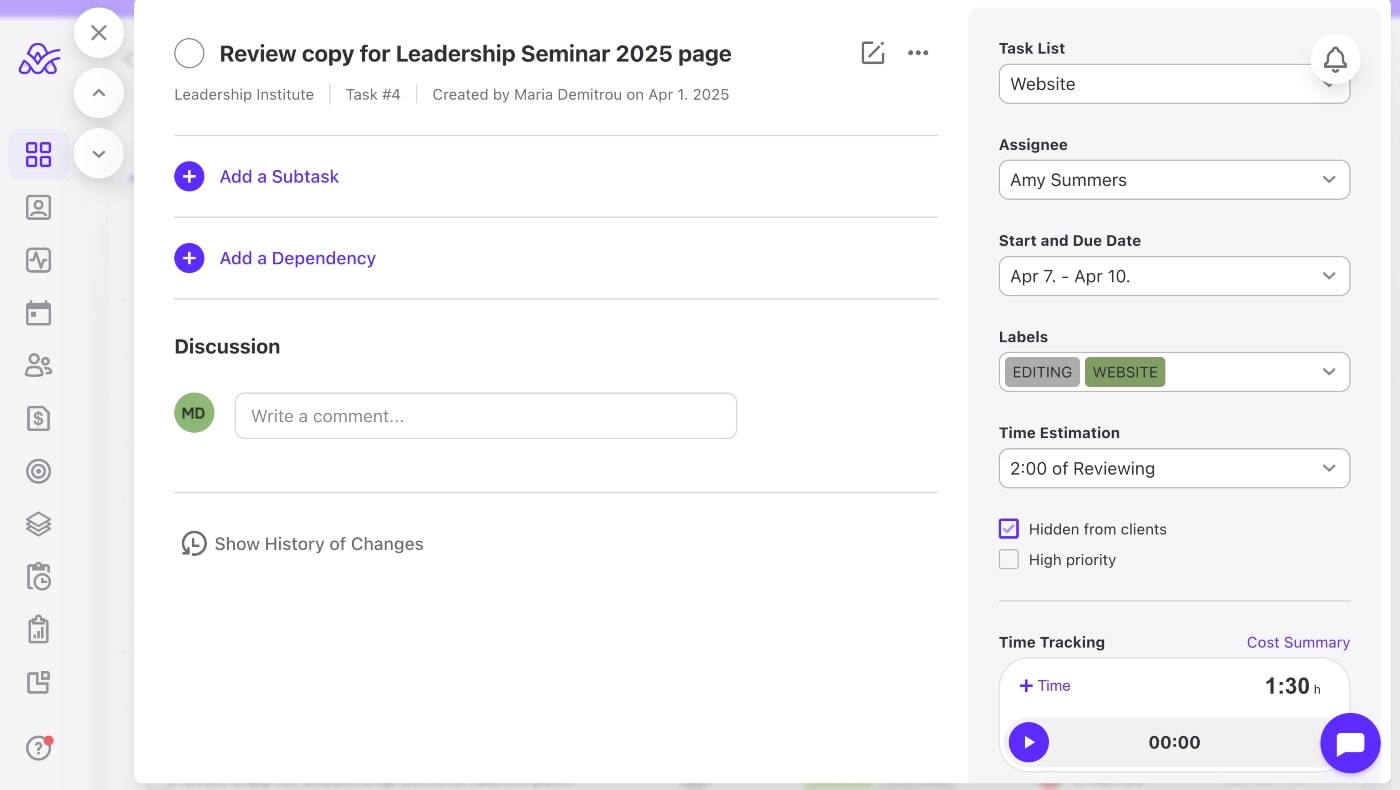

Insight: Clients value transparency. When they're forking out thousands of dollars for your services, they want to know exacty how that money is being spent. ActiveCollab makes this part super simple for service businesses because clients can view all the time and expenses associated with their tasks, unless you select the "Hidden from clients" tick box within the task.

Step 3: Choose your tracking method and set up your system

When you have a clear policy around billable hours and when your clients and teams a familiar with it, the next step is to decide which time tracking method works best for your team and business.

The key here is to balance accuracy with ease of use.

Now, as far as tracking methods go, there are several options, but in the context of billable hour management, here are some strategies that have proven helpful time and time again:

- Manual time tracking: This is the old-school, spreadsheets or paper timesheets way which remains a viable option for some businesses. Create columns for Date, Client Name, Project, Task Description, Start Time, End Time, and total hours.

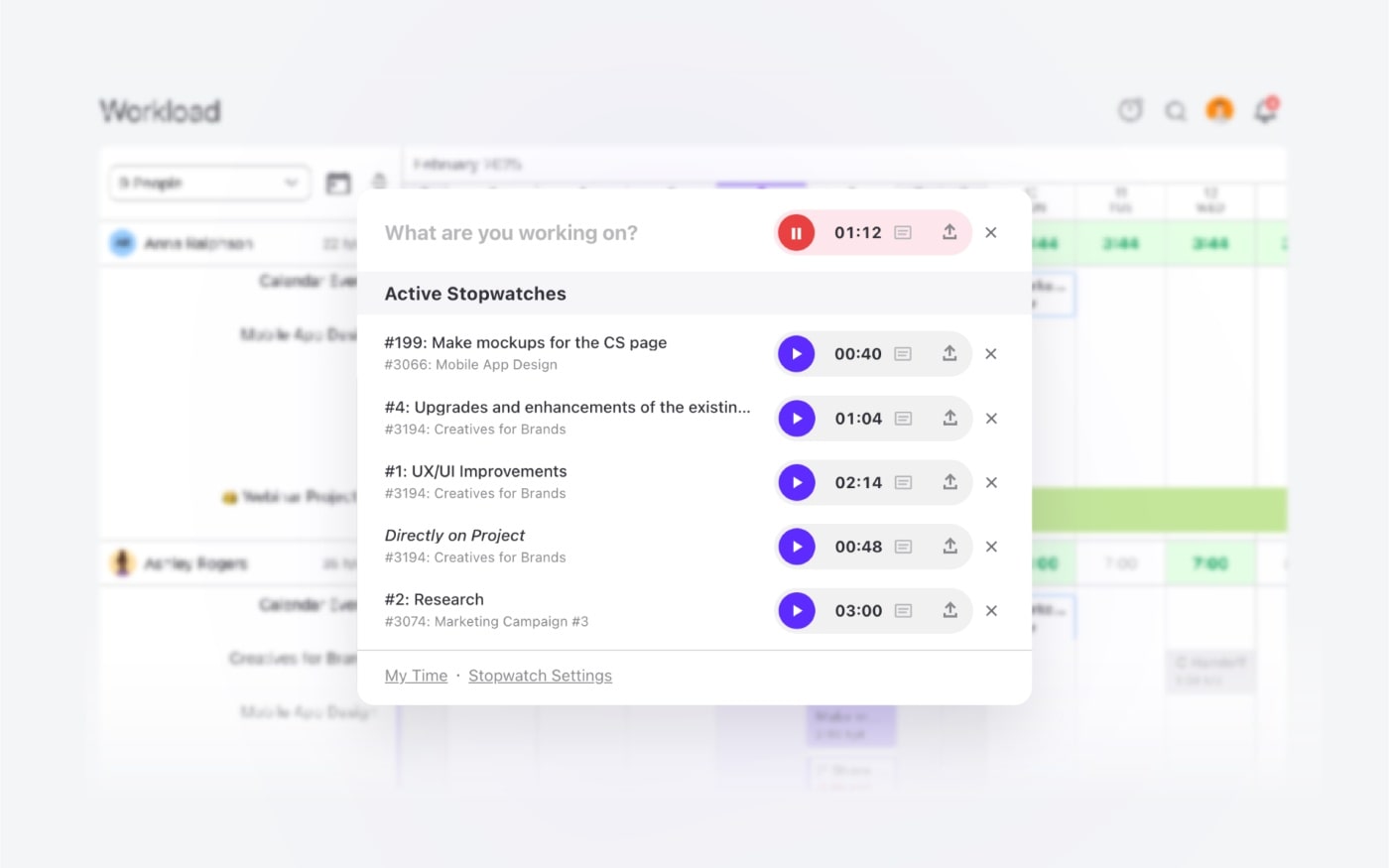

- Time tracking software: The other option is to use time-tracking software tools which let you use timers to track time more accurately, which automates half the process. They offer automatic logging with start/stop buttons, improving accuracy and reducing the administrative burden.

- Project management integration: The best option is to use an integrated project management tools with built-in time tracking, like ActiveCollab. This allows your team to track time within the same system you use to manage tasks and projects, helping to resolve common time management problems.

Insight: Before you choose a method, it might be a good idea to talk to your team and see what tracking system they would actually use consistently. After all, they know their work habits best, and asking for their input also helps ensure adoption. Check out our modern guide to employee time tracking to find out how to implement time tracking software and introduce it to your team successfully.

Step 4: Implement best practices for accuracy

Implementing the right tracking method is only half the battle. If and how your team uses the method is what determines if you’ll capture all billable hours or continue losing revenue thanks to poor practices.

The first thing you need to do is find a way to encourage your team to be disciplined and consistent, which, let's face it –– is easier said than done.

Here's where you can make a start if you want to help your team track and log billable hours more accurately:

- Encourage real-time tracking – Encourage your team to start tracking as soon as they begin working on any client task, so they can eliminates the guesswork that leads to under-billing

- Use appropriate time increments – Use the confirmed billing time increments stated in your policy document, which is usually six minutes for law firms and 15 minutes for agencies and consultancies

- Write detailed descriptions – Get your team to provide specific descriptions of work performed, progress made, and value delivered

Insight: Remember, the harder you make it for your team to track and log billable hours, the less effective the system will be, so pay attention and consider your options carefully.

While signing up for an integrated project management tool like ActiveCollab may seem like an extra cost initially, the reality is, that it's actually an investment. First, consider the revenue you might be losing out on because of inaccurate tracking and logging of billable hours.

Second, think about the amount of time wasted on manual billable hour tracking processes that could have been spent on client work. It all adds up, and it can all be automated, streamlined and simplified with the right task time tracking software.

Step 5: Calculate your optimal billable hour rate

If you’re tracking all your billable hours but charging too little for them, then it’s time to reconsider your pricing strategy. This calls for a systematic approach to rate setting.

By having a data-driven method for determining your rates, you can ensure profitability while remaining competitive in your market.

To calculate billable hours effectively, you need to consider multiple ways to approach rate calculation:

- Input your costs: Enter your total annual expenses including salaries, benefits, office costs, and equipment to establish your baseline.

- Determine billable employee hours: Calculate employee utilization rate so you know how many billable hours you realistically have to work with (typically 1,200-1,500 for full-time professionals)

- Add profit margin: Include a 20-30% profit margin to ensure business sustainability and growth.

- Compare market rates: Access industry benchmark data to ensure your rates are competitive within your specific market.

Here is a quick billable hours example of how rate calculation works:

Annual employee costs of $80,000 ÷ 1,400 billable hours + 25% profit margin = $71.43 per hour

Insight: If you want to dive a little deeper into this topic, check out our customer profitability analysis guide for agencies and consultancies. This will explain in detail all the things you need to consider and align to make sure you're not underpricing your services.

Step 6: Create effective time tracking reports

Once you have everything set up, it’s crucial that you generate useful insights from all this data, especially to guide business decisions and client communications. Make sure to regularly produce client project reports that highlight key metrics and trends.

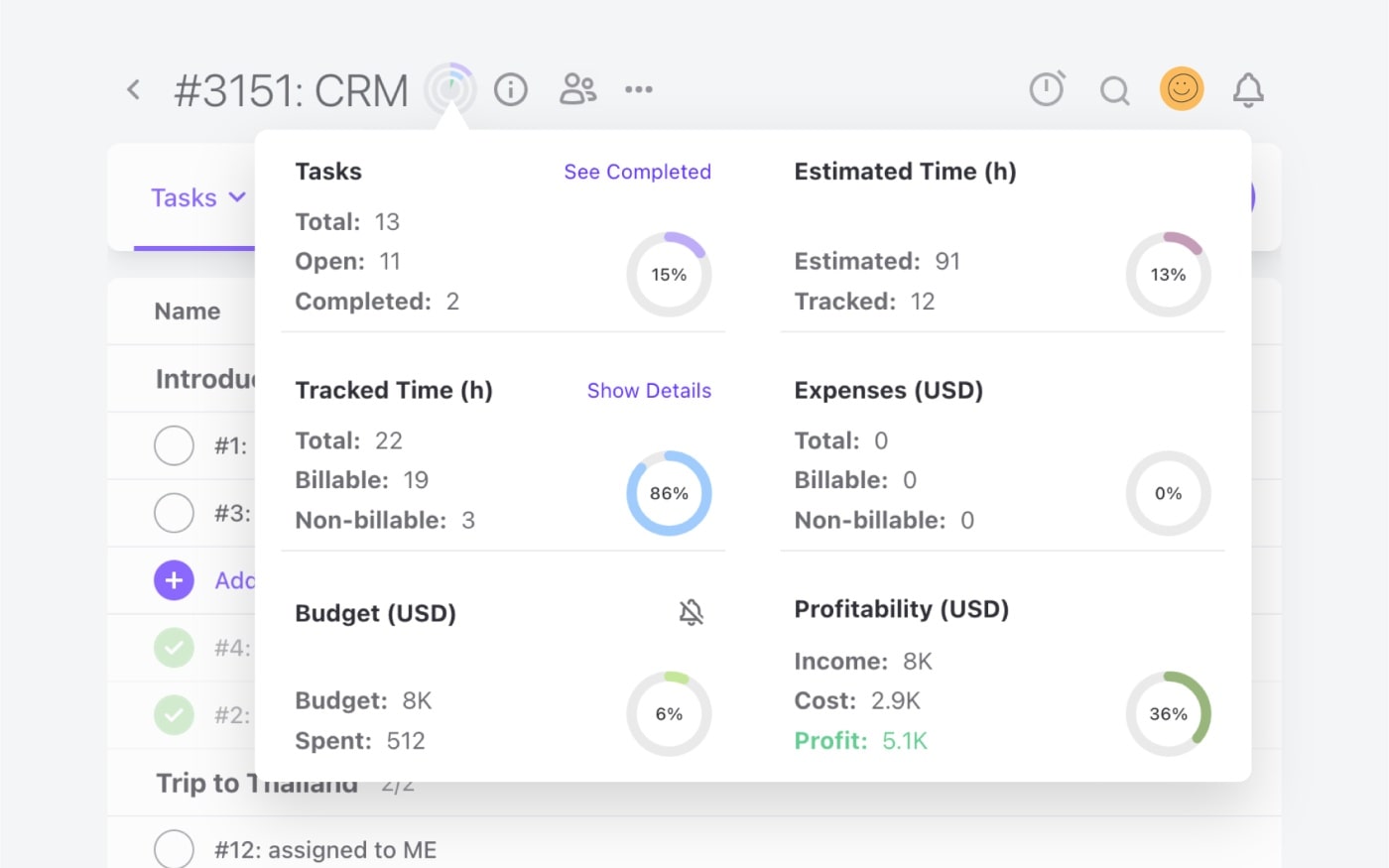

ActiveCollab's is especially useful for providing transparency to clients, but it also simplifies the billing process justification and team performance evaluation.

The tool is ideal for tracking your team productivity and client project profitability. Project overview dashboards let you instantly view:

- Visual summaries of budget spent and project profit

- Proportion of billable against unbillable hours and tasks

- Time spent on individual tasks for both billable and unbillable work

Step 7: Review and optimize regularly

You want your business running as profitably as possible –– that goes without saying. However, some managers, eager to meet billable hours KPIs, push their teams to unrealistic targets that lead to burnout and corner-cutting in time tracking.

This not only leads to inaccurate data but also has a negative impact on the well-being and mental health of team members. Plus, if the only way to meet targets is by working excessive hours, it’s just a race to the bottom.

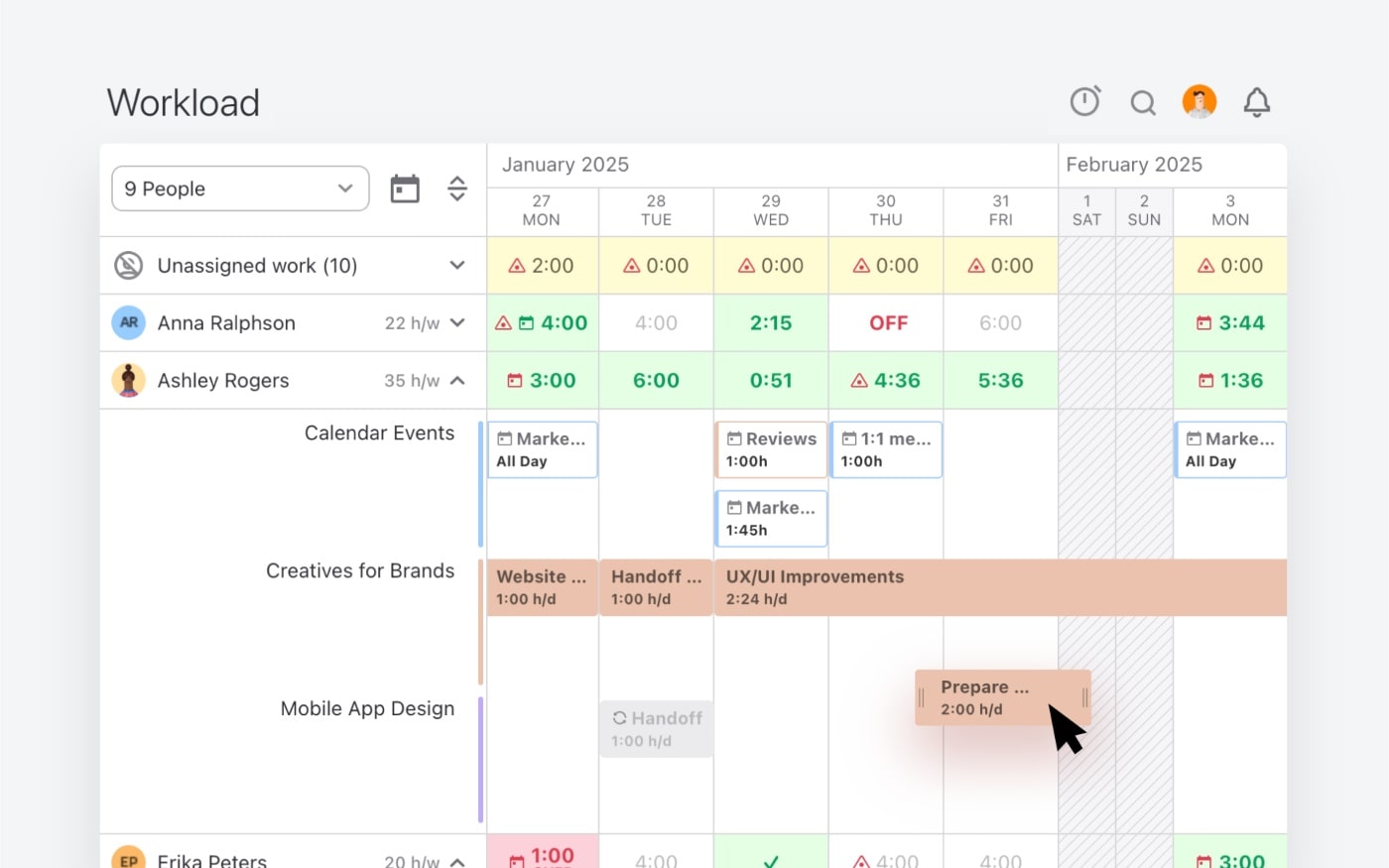

A better way of going about it would be to regularly analyze productivity and workload data to identify patterns and opportunities for improvement. By being aware of how much time is actually being spent, you can make data driven decisions for your capacity and resource planning, and make sure the team's workload is manageable and balanced.

Checking the health status of your team's workload regularly means you can make decisions to improve and smooth out sore spots.

Some things you can do to optimize your team's productivity and balance workloads include:

- Use capacity planning tools like ActiveCollab to distribute and align client work to the available bandwidth

- Automate as many unbillable tasks as possible to leave more room for your team to focus on billable work

- Review processes to see if you can make efficiency improvements and take back wasted time

- Cross-train and upskill team members so you don't limit certain types of work to a few individuals and you can have more options when reallocating tasks

Step 8: Address time tracking challenges

Billable hour tracking is a process, not a one-time fix. This means you need to be aware of the common obstacles that might prevent consistent and accurate tracking of billable hour.

Some professionals forget to start timers, while others struggle with constant task switching that makes it difficult to maintain clear boundaries between different client work.

Here are a few ways you can manage these challenges:

- Combat forgetfulness: Set phone reminders or use tools with built-in time-tracking where you can start and stop the timer within the actual task (like ActiveCollab)

- Minimize task switching: Implement time blocking in your schedule, so that team members can focus on one client at a time whenever possible

- Handle client pushback: Provide detailed time logs with specific descriptions that clearly demonstrate value delivered

- Improve estimation accuracy: Use historical time data to create more realistic estimates for future similar projects

- Ensure team adoption: Make time tracking a core part of your culture with regular training and by highlighting its importance to the business

Make every billable hour count with ActiveCollab

For service businesses, time isn't just a resource –– it's revenue. Whether you're running a marketing or SEO agency, leading a creative studio, or managing a team of business consultants, your profitability depends on how accurately you track and bill your team's time.

Without the right time tracking tools for billable hours, business lose thousands of dollars each month in potential revenue. Whether it's due to poor time-tracking practices, unclear billing policies or administrative inefficiencies, is irrelevant. The fact is, mastering billable hour tracking is essential for a service business's survival and growth.

That's where ActiveCollab comes in. With service businesses in mind, the tool has been tailored to meet the needs of client-facing businesses managing multiple projects and pricing structures. ActiveCollab integrates all your client work into one platform letting you manage project tasks, time logs, budgets and invoices in one place.

With workload, productivity and profitability dashboards and reports, you'll have all the data you need to opitmize resource allocation and build stronger more transparent client relationships. You'l be able to assess project profitability, identify overworked and underutilized employees, so you can set fair pricing.

Want to track billable hours the smart way?

Sign up for ActiveCollab's 14-day free trial or book a demo with one of our people.