Billing is too important to leave it to your accountant. You want to bill quickly and often bill to keep money coming in at all times - the last thing you want is to miss payroll and lose employees.

But to bill often, the process has to be really quick and simple. Otherwise, you'll keep putting off creating invoices, work without invoice will pile up, and when you finally do send an invoice, you'll have to wait for the client to pay it (which usually takes longer than we’d like). All this leads to serious cashflow problems.

How to manage invoices

The main trick to invoice quickly is to have all the data already in place - and just press a few buttons. Every task you worked on and the time you spent should immediately become an invoice item.

To get to the stage where you can invoice in under a minute, you’ll first have to make sure you’ve planned the project and divided the work into tasks. Then, you and your team need to track time on those tasks.

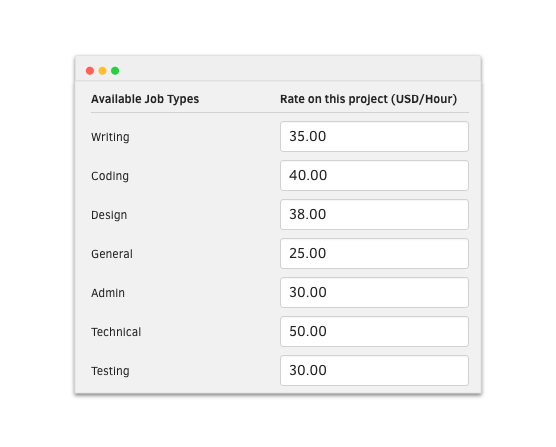

Not all-time records are equal, though. For example, to make a landing page, you’ll do designing and coding - which have different hourly rates. Each time record should specify the type of work, so you can bill accordingly. Same with clients - some clients you’ll charge more and others less for the same type of work, depending on your agreement.

To make invoice management easier, start working on a project on either the 1st or 15th of the month. Alternatively, you can invoice every week or when you reach a predetermined milestone.

When the time comes to send an invoice for the first batch of work, see what time records you didn't invoice on the project and invoice them. To make it easier for clients to review the invoice, group the items by either task, project, or job type.

Each invoice should have:

When sending an invoice, write a quick summary email, explaining where the money went and what the benefit is. For example, an invoice may say "Implementing AJAX - 14 hours" but the client won't get it; explain it in simple terms, e.g. the site will load faster. Also, reassure them that everything is going well and as planned. They can’t understand your work and check your reasoning, so all they want to know is if everything is ok.

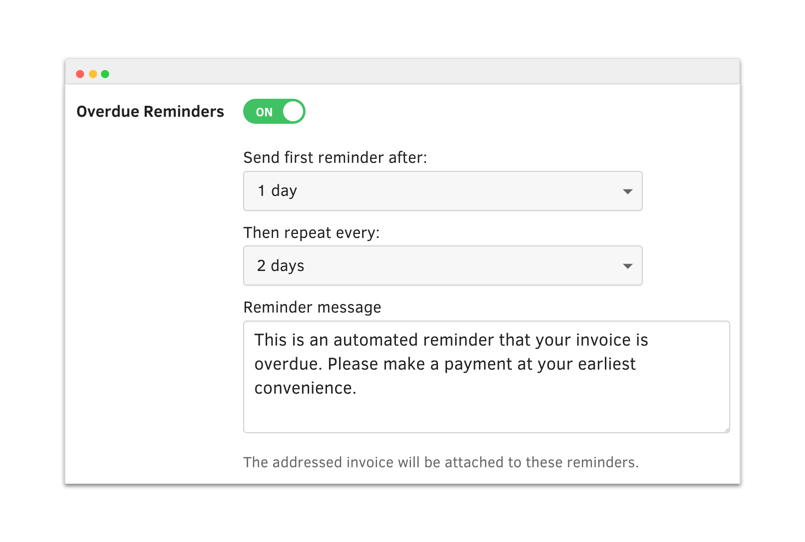

When you create an invoice, send it as a PDF by email to your client. If the client forgets to pay it after the due date, set up an automatic email reminder, to apply constant (but reasonable) pressure to pay the invoice.

If the client misses a payment, immediately stop working. It's better to be safe than sorry when it comes to money. This is why, during contract negotiation, your goal is to specify the payment schedule and the payment due date. The earlier you catch a non-paying customer, the sooner you can take action and not bury yourself in more work, hoping they’ll pay eventually.

If you can, go for convenience and let your clients pay in one click by setting up online payments. You can receive payments on your account using any of the online payment processing companies (like PayPal, Stripe, AuthorizeNet, and Braintree).

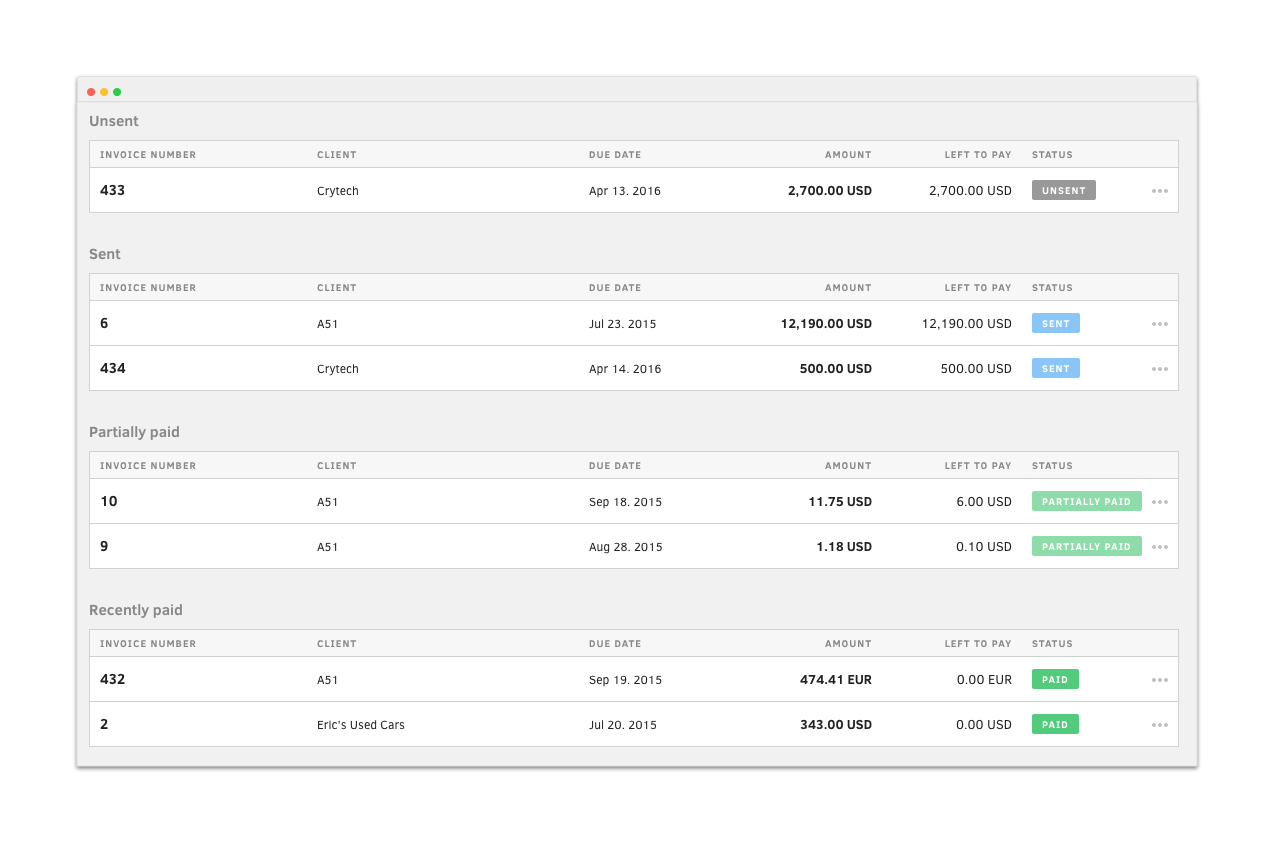

Keep track of all your invoices and their status levels. When you have multiple clients, it's easy to forget who paid what or how much. Keep invoices visually recognizable and organized (know which are due, unsent, or paid partially) to know if you need to take action.

Use recurring invoices for clients that keep you on a retainer. Simply creating a standard invoice and setting it to go off automatically each week/month/quarter is enough to save you a few hours and make you more productive.

Online accounting software (like QuickBooks) is great for both bookkeeping and billing. The best thing is, you can manage your tasks and time records in ActiveCollab and send them to QuickBooks for further manipulation. This will save your team and your accountant a lot of time because they don't have to update each other. You just create an invoice in Active Collab from the tracked time and let accounting software take care of it in their accounting app.

Special invoicing items

You'll have expenses on projects that don't relate to your services. These things can include hosting, domain, stock photography, etc. Before you buy anything, double-check with the client and use their money only after they approve.

If you pay for the expenses using your own money and get reimbursement through the invoice, make sure to visually separate the expenses from hourly rates. You don't want your client to see a huge bill and think they paid you more than agreed.

Think about whether you'll include the project manager or sale agent fee in the invoice, or absorb it through the profit the company makes. A project manager can spend a lot of time communicating with a client, but they don't get to log their time and include it in the invoice; still, it’s a project expense.

Not all clients are the same. Some are wonderful to work with, and some are a nightmare. You have the power to reward good clients by giving them an angel discount and deter difficult ones by including a jerk tax (you don’t want to call it like that on the invoice).

A client earns the angel discount by being polite, providing feedback on time, paying invoices dutifully, and generally being a nice human being. Grant them 5-10% of the invoice or do something more than you promised.

Good clients are hard to come by, so give them a little extra service. Care about them a little more than you have to. It'll leave a strong impact and make it more likely they'll come again - good clients are worth the money if it means you get to work with them again.

Keeping an Eye on the Budget

During the project kickoff, you agreed on the budget with your client. The problem is, you sometimes run out before you finish the project (due to scope creep or underestimating time and expenses).

To prevent going over budget (or at least spot the problem early on to take action), you need to track the budget on a project-by-project basis.

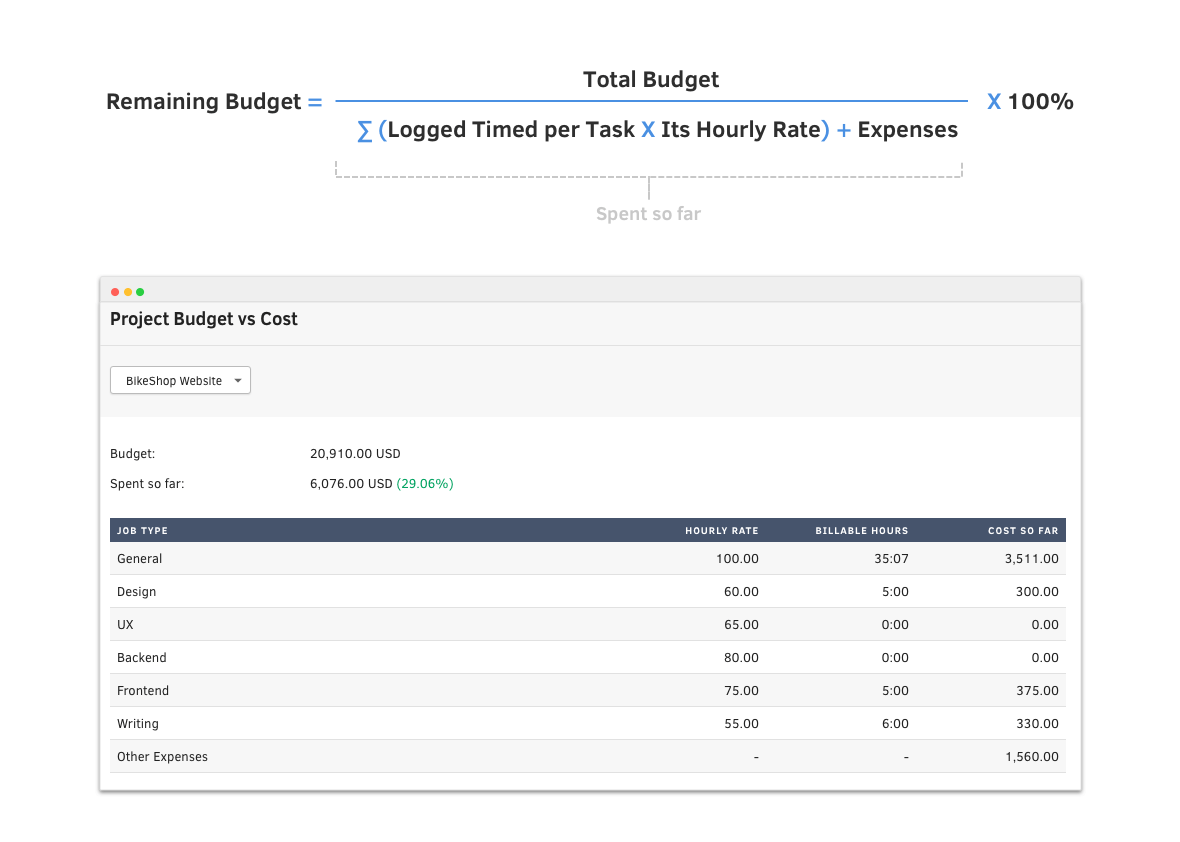

You can see how much budget you've spent by following this formula:

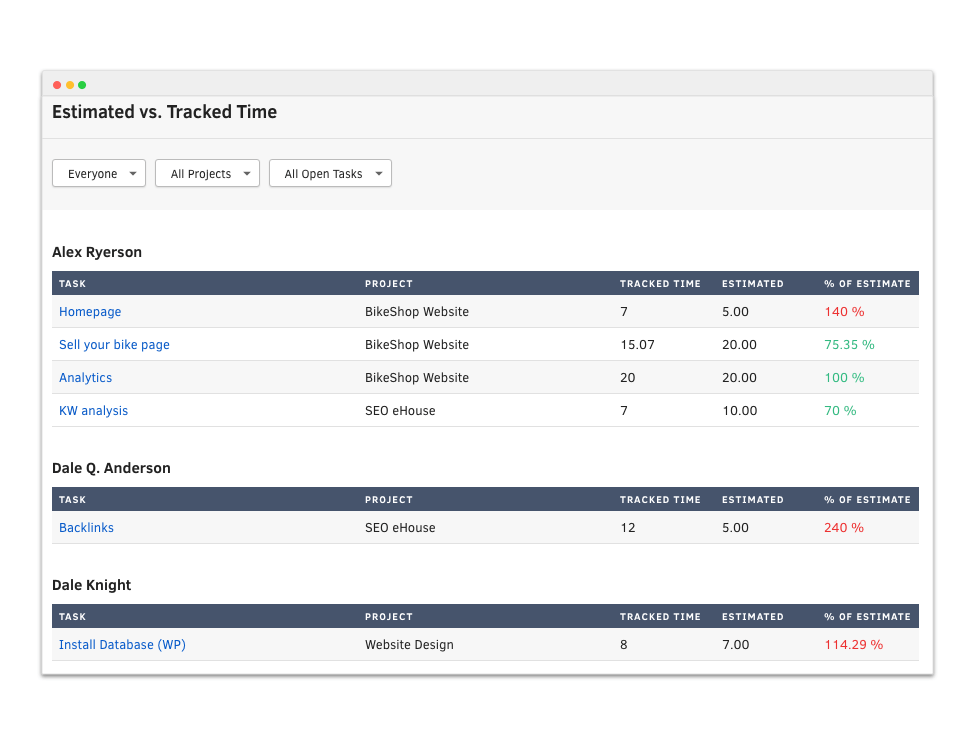

If you spent more in the first phase than you initially planned, you need to know why that is. The best way to find out is to see the estimated vs actual time tracked breakdown for each task. By comparing the estimated time, spent time, and the % done, you’ll get an idea on whether you’ll be on time and on budget.

Then you can see if a certain task took more time than planned, ask why, and talk with your client with actual data at hand.

You should get in the habit of updating your client weekly on the budget status. This way you save both from having the awkward conversation when something goes wrong or catching them by surprise and making them wonder where the money went. If they're updated constantly, they'll know where the budget went and when it's time to talk about the best course of action.

Don't sweep any delays or problems under the rug, hoping the team will catch up. Be upfront and make things right before the situation goes out of hand - don’t waste your time trying to correct the mistake or make the client pay for it.