Financial Management

Project profitability and budgeting done right.

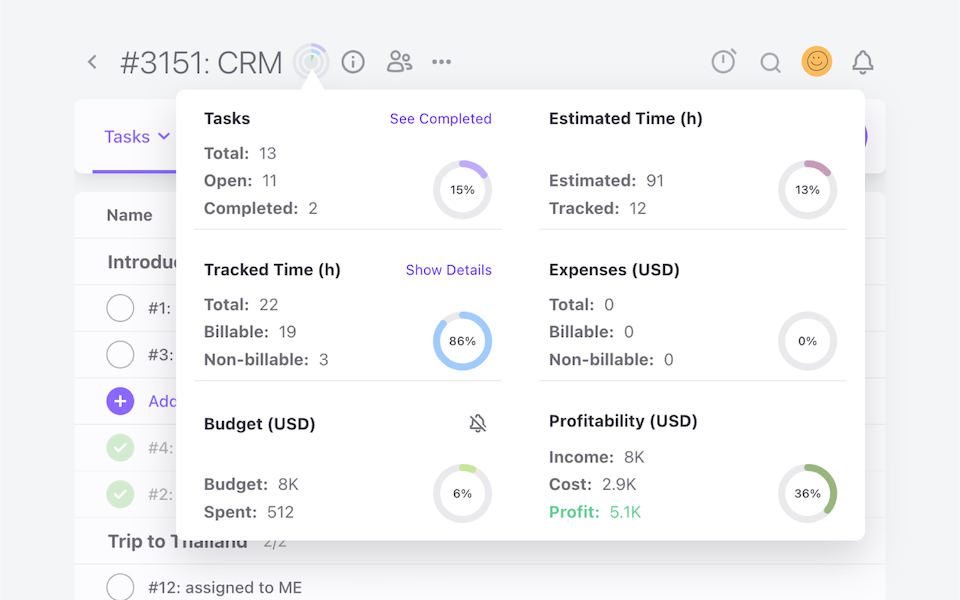

Maximize your profits by understanding and controlling them through a single workspace. Set and track budgets for every project—fixed, expense- or time-based.

needed

Project Cost Tracking Software - through time with flexible rates

Always understand where you stand with your project profitability and expenses.

Same Job - Flexible Rates

Include different time-based job rates depending on the client or project.

Billable and Non-Billable Time Records

You can understand your project cost and individual productivity through time records no matter how they are billed.

Internal Rates

Understand your project costs by allocating internal rates to your team, linked with their capacity and utilization.

Multicurrency

Run your business internationally with different currencies across job-type rates.

Project Budgeting Software

Choose the right budgeting type to control project profitability or client-specific requests.

Non-Billable Projects

Internal or specific projects can be set as non-billable, with no impact on your profitability score.

Fixed Project Budgeting

Track your budget and time spent against a fixed amount.

Expense and Time-Record Base Budgeting

Track your billable hours and expenses, and charge your clients at regular intervals or upon project or task completion.

Budget Alerts

Set budget threshold alerts, and make sure you stay abreast.

"ActiveCollab helped in making the transition smooth when we were pushed toward home working and was one of the key factors in maintaining the quality of our work."

Interior Designer, Havelkadesign

"ActiveCollab sounded too good to be true. We went into our trial period with low expectations – to our surprise and delight, we were proven wrong."

Founder and Creative Director, JUICE Creative Group

"ActiveCollab allows our teams to ask questions, track and update statuses, report time, and communicate effectively and efficiently."

Director, Strategic Accounts, Xivic

"We've gotten way more efficient with our time management and communication, and a big part of that is because of ActiveCollab."

Founder and Managing Director, Rock Agency

Invoicing with Payment Gateways

Create and send invoices directly in ActiveCollab. Sync invoices with QuickBooks and enable card payments.

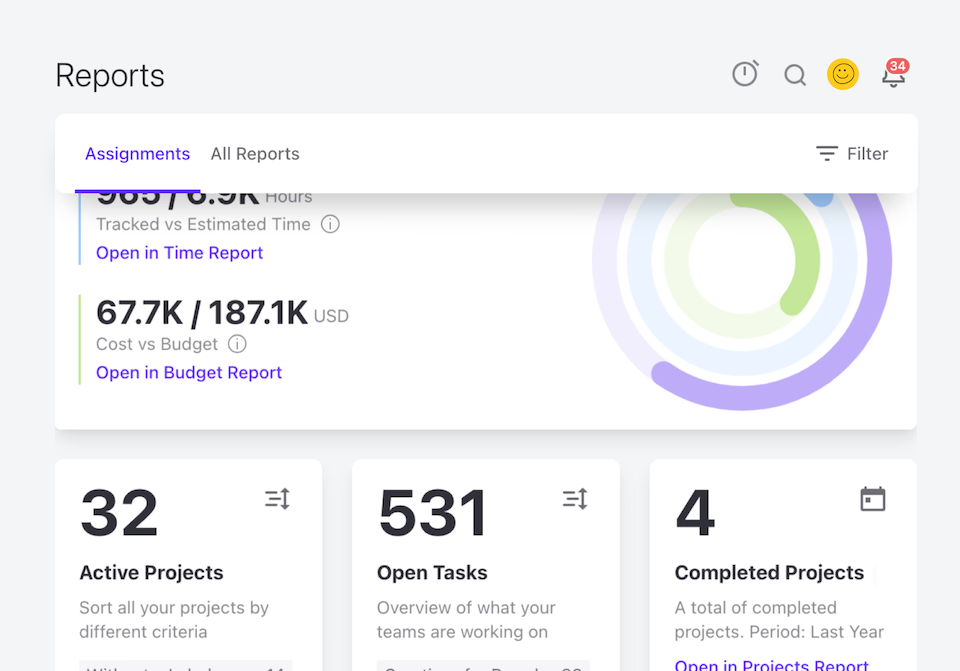

Dashboards and Reports

In this simple-to-use dashboard lies the heart of your business. Don’t miss a thing. Plan with ease.

↳ What you can see in Dashboards and Reports

Success and Support

50K Teams

93%

Happiness Score

Help Center

Additional Onboarding Services

Engaged Community

Frequently

Asked

Questions

Here is more info to help you decide. Contact our Customer Success team if you have other questions.

ActiveCollab gives you a live view of project budgets as work moves forward. Every tracked hour and logged expense updates the budget instantly, so you always know where things stand.

No waiting for end-of-month reports or manual spreadsheets – you see progress and spending as it happens! This visibility helps agencies make smarter decisions on the spot, protect margins, and keep projects on track financially while work is still underway!

Yes! ActiveCollab lets you set budget thresholds for each project and notifies you when you’re getting close to the limit. These alerts act like an early warning system, so you can course-correct before costs spiral.

Whether it’s adjusting timelines, reassigning tasks, or resetting client expectations, you’ll know when to take action. This keeps budgets under control, reduces unpleasant surprises, and gives your agency the tools to manage profitability proactively!

Budgets in ActiveCollab are tied directly to tracked time and project expenses. As your team logs hours or records costs, the budget updates automatically. That means you’re not juggling numbers between tools – everything lives in one place!

This connection makes it easy to see how billable hours and costs are impacting profitability in real time. It’s a simple way to ensure your financial picture is accurate and always up to date!

Absolutely! ActiveCollab doesn’t just show you budgets – it shows profitability as projects evolve! You can compare revenue against actual costs and see whether margins are holding up before the project is even finished.

This lets you step in early if a project is at risk of running over budget or consuming too many hours. For agencies, it’s a major advantage: you manage profitability as you go, not after it’s too late.

Yes! ActiveCollab allows you to log both billable and non-billable costs, giving you a complete view of project finances!

Non-billable items – like internal hours, admin time, or extra expenses – often chip away at margins without being noticed. By tracking them alongside billable work, you get a clearer picture of true profitability.

This insight helps you understand where resources are being used, which projects drain profit, and how to make smarter financial decisions moving forward!

Absolutely! ActiveCollab lets you compare initial budget estimates with actual time and expenses once a project wraps up. This comparison highlights where things went off track and where planning was accurate.

Over time, these insights help agencies improve forecasting, set more realistic client expectations, and avoid underpricing future projects.

Instead of looking back with guesswork, you get data that shows exactly how well your estimates held up against reality.

Yes! ActiveCollab creates profitability reports that show revenue, costs, and margins at a project or client level. You can share them internally with stakeholders to guide business decisions, or externally with clients to provide financial transparency.

These reports make it easy to back up conversations with real numbers, whether you’re reviewing performance, justifying costs, or planning next steps.

It’s reporting designed to turn raw data into actionable insights!

ActiveCollab’s budgeting features don’t just keep individual projects on track – they help agencies plan for growth. By tracking budgets, costs, and profitability across multiple projects, you spot patterns that affect long-term performance.

You’ll know which types of work deliver the best margins, when to adjust pricing, and where resources are being overextended.

With this financial clarity, agencies can scale more confidently, forecast revenue more accurately, and make strategic decisions with data to back them up!