Bots never blush when it comes to asking for money

Asking for money is always awkward, even when you've earned it. The most common advice is to just "suck it up and ask what you deserve", but that’s not very helpful.

For one, when you remind clients personally that they’ve missed a payment, you damage the relationship with them, especially if they're raised in a culture where it's impolite to talk about money. When you personally send them a due date reminder, you're basically telling them:

I did the work but you failed to honor your end of the bargain. I don't trust you anymore and think you're a thief. Prove me wrong and pay me or else I'll tell everyone you're a flaky, good-for-nothing deadbeat.

No matter how friendly you write the message, it’ll make you and your client lose face. But there's a solution.

Due date reminder

To avoid awkwardness when chasing late payments, automate it. No one will lose face because computers and automated messages aren’t subject to the same sociocultural dynamics as we are. This makes them perfect for doing the awkward stuff.

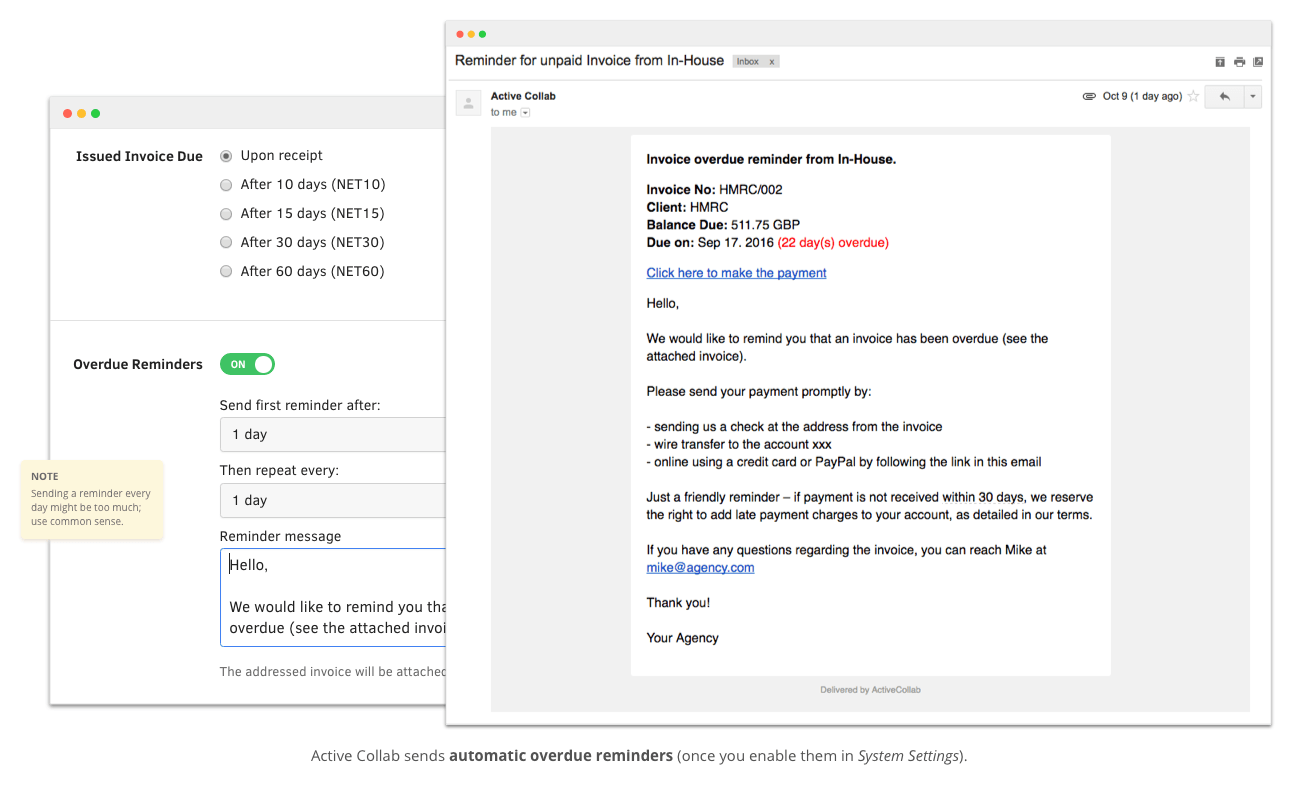

All you have to do is write a message, define when to send the first reminder, and how often to send additional reminders after the first one.

To avoid awkwardness when asking clients to remit payment, automate it.

Automating sending due date reminders is great for several reasons:

You'll save a good client relationship

Automated messages are depersonalized and as such, they don't damage the client relationship, yet they get the job done. When a client receives an automated overdue invoice reminder, you can just say it's the system, and you don't have anything to do with it, but it would be nice if they pay now so THE SYSTEM stops sending the emails. It’s not you, it’s the system.

You'll never forget to get paid

When you're working on a lot of projects, sometimes you forget to bill and when it comes time to collect the money, it'll be too late (eg. client disappeared, company dissolved, or you can't legally collect payment when it’s xx days overdue). By automating overdue payment chasing, you remove the human error factor.

You'll save time

Checking who you have to send a reminder to, writing the payment reminder letter, and attaching the invoice can eat up a lot of time. Imagine doing that every day. Why do it manually when you can avoid it altogether with just a few clicks?

There are some fixed fees you charge your clients every week or month. That's why ActiveCollab has a special invoicing feature called Recurring Invoices, which are invoices that are automatically created and sent.

Unpaid invoice reminder letter

Hello,We would like to remind you that an invoice has been overdue (see the attached invoice).

Please send your payment promptly by:

- sending a check to the address from the invoice

- wire transfer to the account xxx-xxx-xxx

- paying online using a credit card or PayPal by following the link at the top of the email

Just a friendly reminder – if payment is not received within 30 days, we reserve the right to add late payment charges to your account, as detailed in our terms.

If you have any questions regarding the invoice, you can reach Mike at mike@agency.com

Sincerely yours,

In-House Agency

Include a call to action in the message, so the client can pay immediately while the email is open. The easier it is for them to pay right there and then, the greater the chance they'll actually pay. You may have agreed in the contract on how to pay, but don't make them go through the contract to find the information; write in the message how they can pay and details they need to do it.

Most people pay late because they are disorganized. ActiveCollab's invoicing engine sends the PDF of a due invoice in every reminder message, so the client doesn't have to hunt for it in their inbox.

Remind the clients of the late interest fee you're charging to incentivize them not to wait any longer. For example, you can add a 15% fee if the invoice is it isn’t paid in full within the first 30 days and another 1% for each day after 45 days. Small percentages often don't cut it, so the fee has to be high enough to actually incentivize clients to pay on time.

To charge an overdue payment fee, you need to stipulate it in your [contact]. If you haven't, you can still legally charge an overdue fee, as prescribed by your country’s law. For example, in the UK you can legally charge an 8.5% interest rate if another business is late paying for goods or a service, as defined by the government.

Don't forget to include your contact information. Sometimes unexpected things happen and the client first needs to talk to you. Or, if they're forwarding the message to the finance department, and they need to contact you for some clarification, they don't have to wait for the contact information because it's right there.

Automate sending overdue payment reminders, so clients pay their overdue invoices. Don't tarnish your client relationship with an awkward discussion about money and who didn't pay what - instead, let ActiveCollab take care of it for you.