Keeping your business healthy and stress-free

When was the last time you analyzed your customer list? Maybe it's time to see which customers generate profit and which ones just weigh down your business, so you can do something about it.

Project profitability is strictly linked to the customer profitability analysis, which doesn't take much time, one hour at most. There are two goals:

- Identify customers that waste a lot of your time but don't bring enough profit

- Identify customers who could bring you more profit if you only had the time to focus on them

Once you identify your "bad" customers, you no longer have to try so hard to please them. Instead, you can spend that time better, like chasing after new clients.

From my experience (20+ years in all sorts of marketing teams), during this profitability analysis, you shouldn't focus exclusively on quantitative KPIs like profit margin. You have to factor in the qualitative KPIs, too, which are equally important.

For example, a customer pays well (good quantitative KPI), but is so difficult to work with (bad qualitative KPI) that you have trouble keeping your employees. This might even lead your business to lose money on recruitment.

Also, keep the long-term vs. short-term goals in mind. A startup customer may not be profitable now, but once they take off, you'll be sorry you lost them.

Customer Profitability Analysis Example

The first step toward customer profitability analysis is to calculate the profit margin and the profit share per customer.

To calculate the profit margin, take the sum a customer paid and subtract amortized fixed costs (office, taxes, lease, etc.) and variable costs (the time you worked).

Customer A Profit Margin = Customer A Revenue - (Amortized Fixed Costs + Variable Costs)

Then, plot all the customers on a graph to see which ones aren’t worth keeping. You can use Excel or Plotly.

Be completely honest with yourself when trying to track project costs and calculating customer profitability. Take into account each hour you spent on a customer - even non-billable hours, like the time spent in a taxi on your way to a customer meeting.

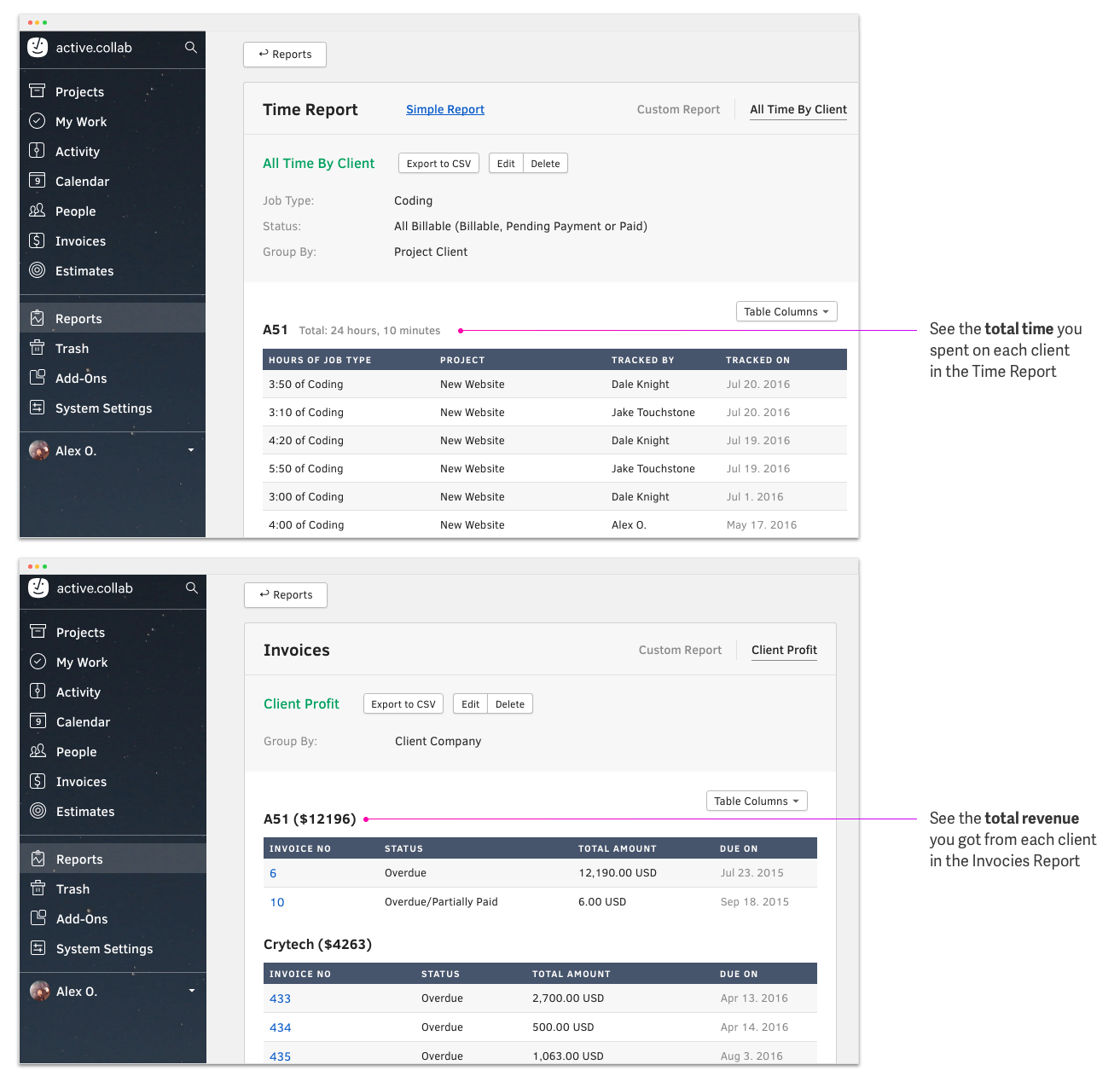

You can get the total value of all your time records for each customer in ActiveCollab’s Time Report. Then, you can run the Invoices Report and see how much money each customer brought in.

To calculate the profit share per customer, divide customer profit with the sum of all the profit and multiply the result by 100%.

Customer A Profit Share = (All Profit / Customer A Profit) * 100%

This will help you identify your biggest liabilities, so you can manage risks better. If a certain customer is responsible for 60% of your earnings, you're in serious trouble because you'll spend so much time servicing them that you won't have the time to find other customers and diversify risk.

When most of your billable hours depend on one customer, you're in a very risky situation. You might need to make subpar business decisions because the customer holds all the bargaining chips. And customers know this - they know how much power they have over you, and they use it.

And it's just a matter of time when they'll leave, and you'll crumble - unless you do something about it now.

There are a lot of reasons why companies keep depending on big customers and having them in their portfolios. The most common one goes along the lines of "they're my A-list customer that gives me leverage when dealing with media." I pretty much heard it all, but in the end, they're all just excuses.

You have to find a workaround, or otherwise, you risk too much. Diversify your customer list and focus on bringing new, more profitable customers instead of letting existing ones impose tighter and tighter deadlines and lowballing your rates.

Note: a small customer that pays on time is always better than a big customer who you need to chase for payments. Stable and healthy cash flow is the lifeblood of every business.

Customer Profitability Analysis Model: Qualitative KPIs

Focus on keeping customers that give you challenges. They are good because they give you the chance to learn and grow, force you to sharpen your skills and push you to become better each day. They are rare, and you should work on maintaining a relationship with them at all costs because they help you stay relevant and current.

Slowly phase out bad customers that make your life bitter. You probably know who they are; even people in your company who don't work directly with them know who they are - that’s how bad they are.

Those are the customers who swamp you with unnecessary emails, want something for nothing, and drive everyone crazy. Those customers are the reason you lose your most valuable asset - your best employees. Get rid of those customers. Most of them are not worth the hassle and energy you pour into them.

Once you set even one of these "vampires" free, your whole company will experience a sudden boost in morale and energy. You'll have more time and creative energy to focus on acquiring new customers who'll fill in the revenue hole. I've done it several times and never regretted it.